Booking Revenue Journal Entries

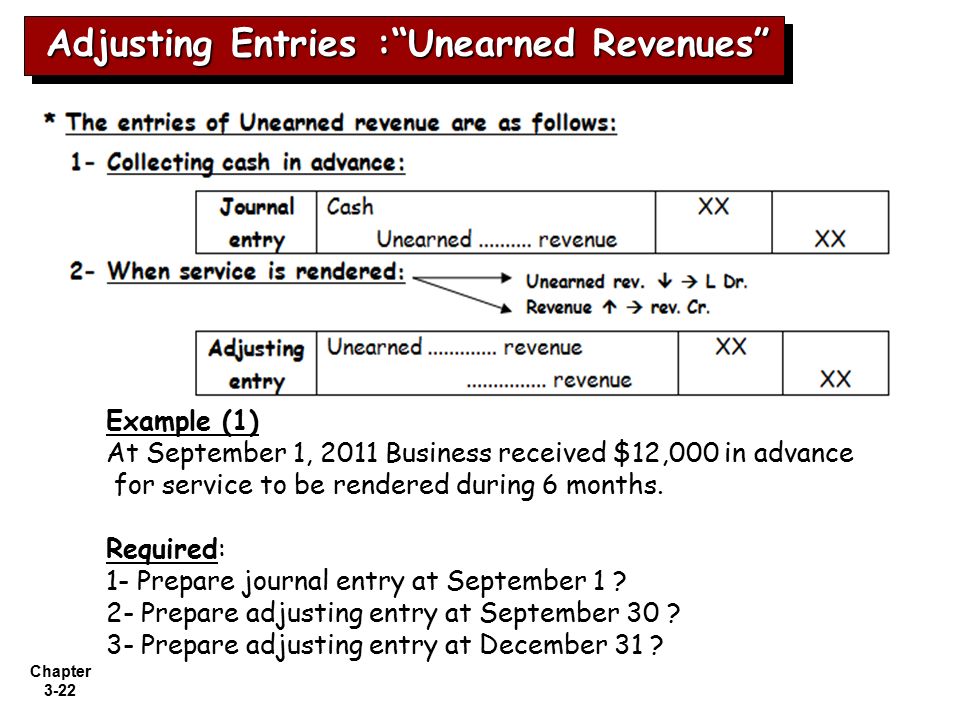

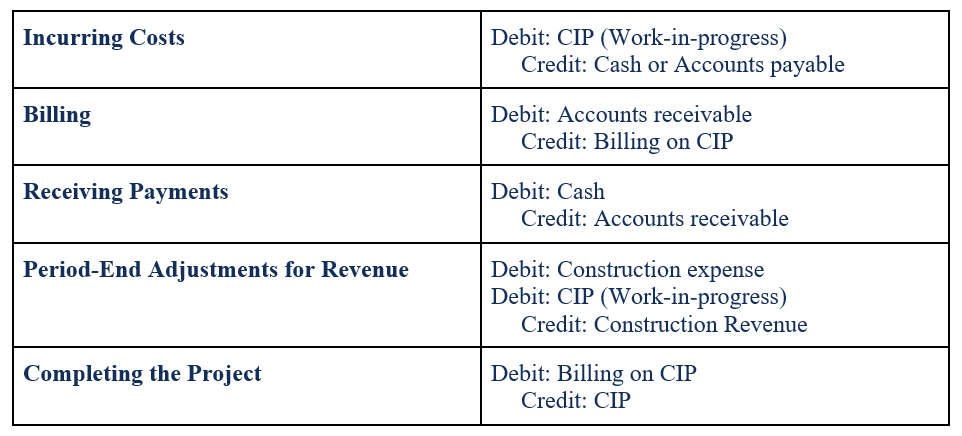

Asu 2014 09 topic 606 asc 606 revenue from contracts with customers has been called the biggest change to financial accounting standards in the last 100 years.

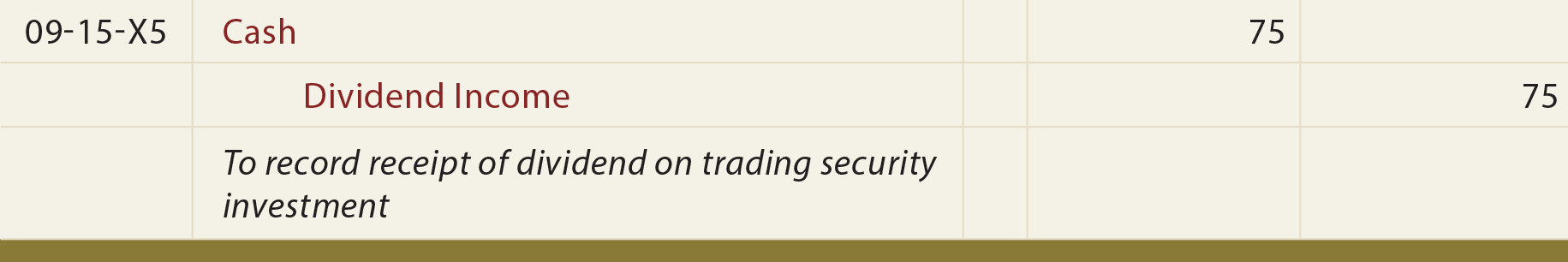

Booking revenue journal entries. In each case the accounts receivable journal entries show the debit and credit account together with a brief narrative. This journal entry needs to record three events which are. Although many companies use accounting software nowadays to book journal entries journals were the predominant method of booking entries in the past.

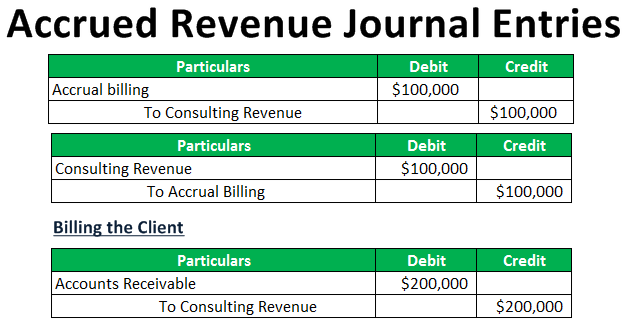

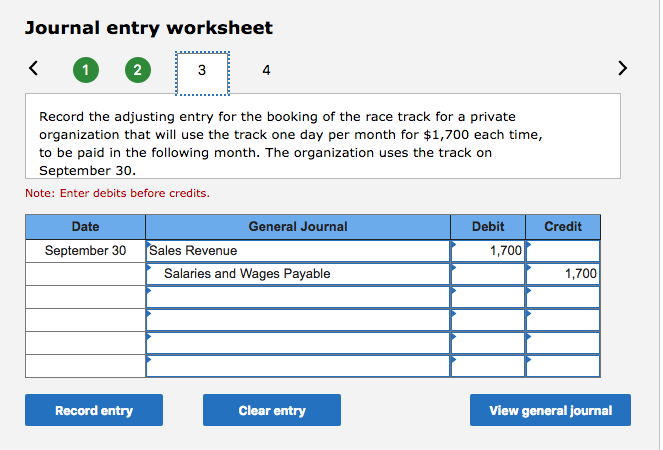

Accrued revenue is the income that is recognized by the seller but not billed to the customer. The recordation of a sales tax liability. What is the sales journal entry.

You ll notice the above diagram shows the first step as source documents. How to approach journal entries. The content of the entry differs depending on whether the.

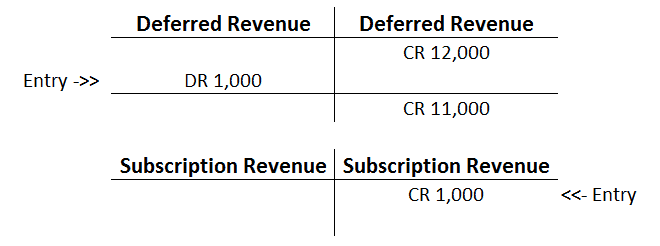

Consider the following diagram. The following deferred revenue journal entry provides an outline of the most common journal entries in accounting. It is not revenue for the company since it has not been earned.

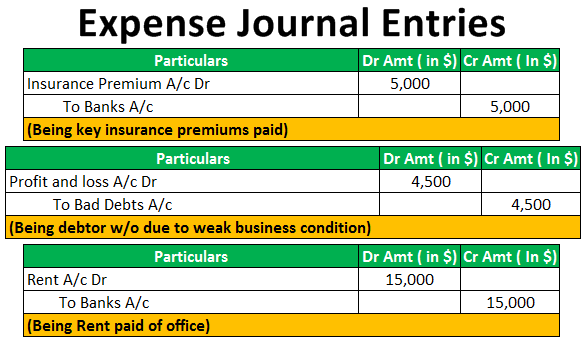

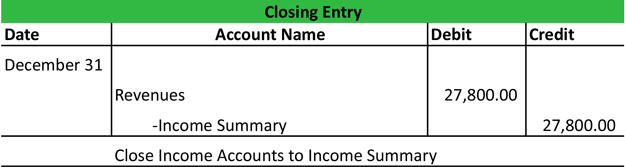

The recordation of a reduction in the inventory that has been sold to the customer. Journal entries are important because they allow us to sort our transactions into manageable data. It is much more common for accountants to commit fraud through the use of journal entries than through the use of such common transactions as recording supplier invoices and creating customer invoices.

Each transaction in business is recorded in the business using journal entry as. What is journal entry. The reason is that these more common transactions have a system of controls built up around them that is designed to detect a variety of issues.