Booking Holdings Debt Offering

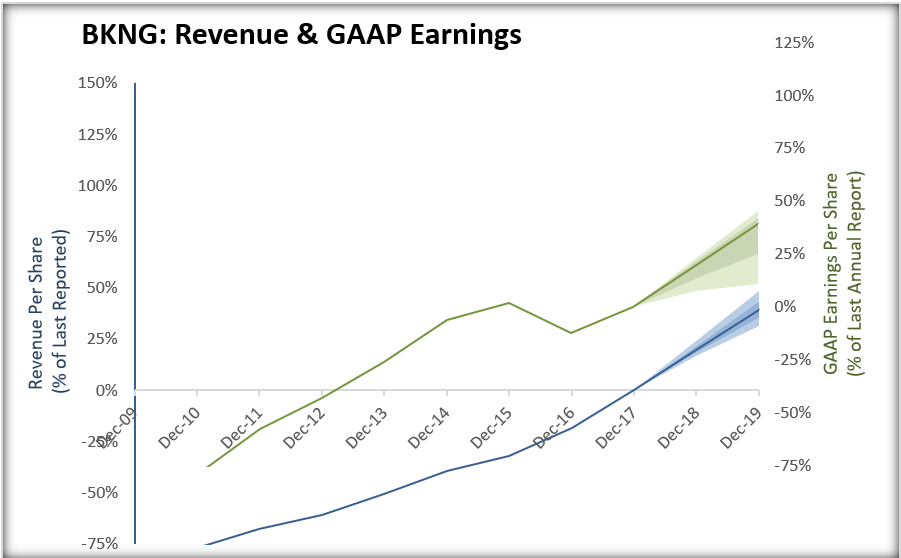

Long term debt can be defined as the sum of all long term debt fields.

Booking holdings debt offering. Current and historical debt to equity ratio values for booking holdings bkng over the last 10 years. Booking holdings estimates that the net proceeds from the offering will be approximately 3 23 billion after deducting estimated offering expenses and underwriters discounts. The offering is expected to close on april 13 2020 subject to the satisfaction of customary closing conditions.

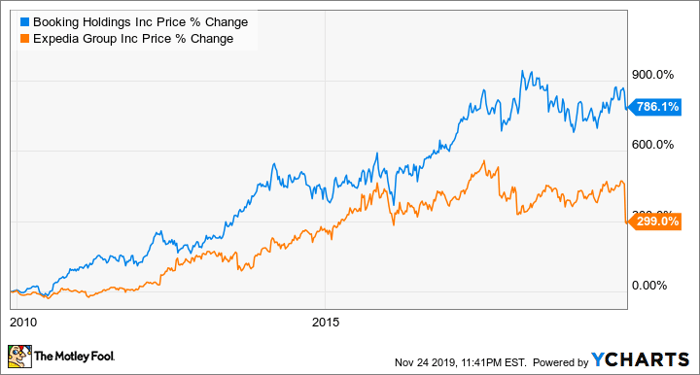

Booking holdings is the world s leader in online travel. Booking holdings long term debt from 2006 to 2020. Online travel agency booking holdings nasdaq bkng is booking a large new issue of debt.

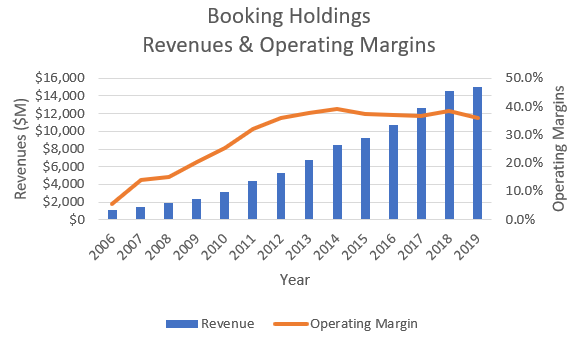

Booking holdings long term debt for 2019 was 8 661b a 11 76 decline from 2018. Debt item description the company. Booking holdings estimates that the net proceeds from the offering will be approximately 735 million or approximately 845 million if the initial purchasers fully exercise their option to.

Booking holdings estimates that the net proceeds from the offering will be approximately 3 23 billion after deducting estimated offering expenses and underwriters discounts. Booking holdings intends to use the net proceeds from the offering for general corporate purposes which may include repayment of debt including the repayment at maturity or upon conversion. Booking holdings inc s total debt decreased from 2017 to 2018 and from 2018 to 2019.

The convertible notes will mature on may 1 2025 unless earlier repurchased or converted. Booking holdings debt equity for the three months ending september 30 2020 was 2 39. The company announced wednesday that it is floating 750 million worth of convertible senior notes.

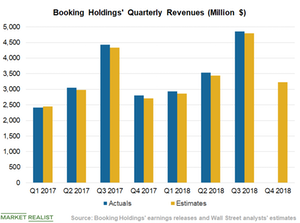

Booking holdings long term debt for the quarter ending september 30 2020 was 11 750b a 37 6 increase year over year. The online travel services operator is offering 750 million of 0 75 convertible senior notes due 2025.